The state of the State

All eyes focus on state's available balance

"AVAILABLE BALANCE" in the

state's general fund — what does the

figure mean to you? If you do business

with the state, are the recipient of a state

grant (such as public aid), or are a state

employee, it is an important figure. This

is especially the case when, as now, the

state is spending more than it is taking in

and the available balance in the general

fund has to be watched carefully to

safeguard against drawing it down to zero.

(The "general fund" in this discussion

is a composite of three funds— general

revenue, common school, and federal

revenue sharing — which account for

two-thirds of state spending.)

"The available . - . balance in the

General Fund is the amount of money

left after expenditures and revenues

have been tallied, like an individual's

checkbook balance," says State

Comptroller George W. Lindberg in The

Dynamics of Illinois State Finance: A

Fiscal Barometer, a 10-page booklet

prepared for a legislative seminar last

fall. "It is the single most important

indicator of the fiscal health of the

state."

Spending exceeds income

For example, the state began October

1975 with a balance of $39 million. Cash

receipts, primarily from taxes, came to

$315 million. Transfers from other

funds added up to $28 million. Federal

aid totaled $95 million. Total receipts:

$438 million. General fund spending

totaled $404 million (including public

aid, $158 million; school aid, $112

million; and state operations, $98

million). Transfers out to other funds

added up to $24 million. Total spending:

$428 million - $10 million less than

income. The closing balance for

October was $49 million (source:

"Comptroller's Monthly Fiscal Report" for

October 1975 released November 18).

Looking into the future is a chancy

business, but the comptroller is able to

project trends which take into account

official forecasts of revenues and what is

likely in the way of spending (based on

appropriations). Projections which he

presented at the seminar for legislators

last fall undoubtedly influenced several

to vote against overrides of the

education appropriation vetoes. These

projections took into consideration

$100 million additional which it is now

agreed will be needed to meet public aid

costs during fiscal 1976 if present

economic trends (and joblessness)

continue. The projections indicated that

the general fund balance would stay

around $40 million until March and

then rise to $100 million in June

(because of seasonal increases in tax

revenues).

Zero balance possible

But if the legislature had increased

appropriations last fall by another $ 100

million — by overriding vetoes on

education appropriations — the projections

showed the balance would drop

to zero in March. If this were to happen,

there would be delays in meeting state

payrolls, in paying the state's bills, and

perhaps in paying public aid grants. As a

matter of fact, the comptroller's November

18 release asserted that "the

Governor's agencies have begun a

slowdown in paying those who do

business with the state. Those affected

are doctors, hospitals . . . and other

commercial enterprises." (A spokesman

for the Bureau of the Budget under the

governor denied a "slowdown"

was occurring at the operating agency level.

Centrally, however, the payment of bills

was being managed to avoid a cash

shortage, he said.)

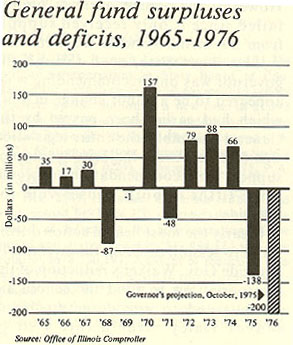

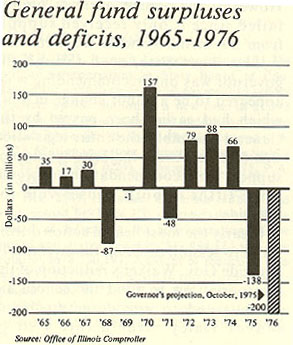

General fund surpluses

and deficits, 1965-1976

|

"Such a slowdown, if it continues, will

have the effect of shifting the cash flow

problems of the state to the private

sector, thereby allowing the state to

partially abandon its fiscal responsibility,

" Lindberg said. "That's bad news

for businessmen."

"To keep the state from becoming a

'dead beat' on paying its bills, we have to

face reality. Very soon we must either

cut spending or find new income."

Penalty for unpaid bills

If payment of bills is put off too long,

it could also cost the state money. House

Bill 221 (Londrigan, D., Springfield)

requires the state to pay a penalty of 1

per cent per month on bills unpaid after

90 days. The bill was vetoed by Gov.

Dan Walker, but passed both houses over his veto.

The state could borrow. The Constitution

permits borrowing up to 5 per

cent of appropriations in anticipation of

revenues and up to 15 per cent of

appropriations to meet deficits "caused

by emergencies or failure of revenue"

(Art. IX, sec. 9). But no enabling

legislation for such borrowing is on the

books. Internal borrowing—switching

from an earmarked fund to a general

fund — was tried during the Kerner

administration, but this procedure

seems of limited usefulness; amounts in

earmarked funds have already been

committed or appropriated.

|

Tax increase in wind?

The chart shows the history of surpluses

and deficits in the general funds

since 1965. The large deficit shown for

1968 occurred prior to the adoption of

the state income tax which brought in a

big surplus in 1970. Do the large deficits

for 1975 and those projected for 1976

presage a tax increase?/ W.L.D.

February 1976/Illinois Issues/23